The Economics of Vietnamese Street Food: High Flavor, Low Cost

Vietnamese street food has earned global admiration for doing something deceptively simple: serving unforgettable meals at prices that seem almost impossible. From bustling Hanoi sidewalks to early-morning markets in Ho Chi Minh City, food is cooked fast, eaten fresh, and paid for with pocket change. But behind the bowls of noodles and crusty baguettes lies an economic system built on efficiency, local supply chains, and deeply ingrained cultural habits. Understanding how Vietnamese street food works reveals why it has remained both affordable and extraordinary for generations.

A Culture Built on Everyday Eating

Street food in Vietnam isn’t a novelty or a weekend treat—it’s daily life. Many locals eat most of their meals outside the home, which creates steady, predictable demand for vendors. This consistency allows sellers to operate on thin margins without needing high markups. When customers show up every morning for breakfast and every evening for dinner, volume replaces price as the main driver of income. Economically, this stability lowers risk and encourages long-term sustainability for small food businesses.

Simple Menus, Powerful Results

One reason costs remain low is a focus on the menu. Many vendors specialize in just one or two dishes, refining them over years or even decades. When travelers ask what are some vietnamese foods worth trying? The answers often come from these specialists—pho stalls that sell nothing else, or bánh mì carts that focus on speed and balance. Limited menus reduce ingredient waste, simplify training, and allow bulk purchasing, all of which keep expenses down while improving quality.

One reason costs remain low is a focus on the menu. Many vendors specialize in just one or two dishes, refining them over years or even decades. When travelers ask what are some vietnamese foods worth trying? The answers often come from these specialists—pho stalls that sell nothing else, or bánh mì carts that focus on speed and balance. Limited menus reduce ingredient waste, simplify training, and allow bulk purchasing, all of which keep expenses down while improving quality.

Local Ingredients and Short Supply Chains

Vietnamese street food relies heavily on local, seasonal ingredients. Herbs are grown nearby, meats are sourced fresh each morning, and produce often comes directly from neighborhood markets. These short supply chains cut transportation and storage costs, which would otherwise inflate prices. Economically, this system benefits both vendors and farmers, keeping money circulating within the local economy instead of flowing to large distributors or importers.

Labor Efficiency Without Sacrificing Skill

Street food setups are famously compact, often run by one or two people who handle everything from prep to payment. This lean labor model keeps overhead low while preserving craftsmanship. Skills are passed down through families, reducing the need for formal training or outside hires. The result is highly efficient labor that still delivers consistency and flavor, proving that low cost doesn’t have to mean low skill.

Infrastructure That Works With the Street

Unlike brick-and-mortar restaurants, street vendors avoid high rents, elaborate interiors, and expensive equipment. A few stools, a cart, and a gas burner are often enough. Cities have organically adapted to this system, with sidewalks and alleys functioning as informal dining rooms. This minimal infrastructure dramatically lowers startup costs, making entrepreneurship accessible and competition healthy, which in turn keeps prices fair for customers.

High Turnover, Fresh Food

Because street food is cooked and sold quickly, ingredients rarely sit around long enough to spoil. High customer turnover ensures freshness while minimizing waste. From an economic standpoint, waste reduction is crucial: every unused ingredient is lost profit. Vietnamese street food thrives by aligning speed, freshness, and demand into a tight loop that benefits both seller and eater.

Vietnamese street food is often praised for its flavor, but its true brilliance lies in its economics. By combining focused menus, local sourcing, efficient labor, and minimal overhead, it delivers exceptional value without cutting corners. It’s a system shaped by culture, necessity, and smart design rather than trend-driven pricing. In a world where food costs continue to rise, Vietnam’s streets offer a powerful reminder that great eating doesn’t have to be expensive—just well thought out.…

Physical album sales remain a significant source of income for artists, especially for those with dedicated fan bases. Vinyl records, CDs, and special edition releases attract collectors willing to pay premium prices. Limited edition albums often include unique packaging, bonus tracks, or autographed items. These features create a sense of exclusivity, encouraging purchases. Even as digital consumption grows, physical sales provide a tangible revenue stream that can last for years, particularly when older albums are reissued or remastered for new audiences.

Physical album sales remain a significant source of income for artists, especially for those with dedicated fan bases. Vinyl records, CDs, and special edition releases attract collectors willing to pay premium prices. Limited edition albums often include unique packaging, bonus tracks, or autographed items. These features create a sense of exclusivity, encouraging purchases. Even as digital consumption grows, physical sales provide a tangible revenue stream that can last for years, particularly when older albums are reissued or remastered for new audiences.

One of the biggest

One of the biggest

Keeping all your savings in a basic bank account is another mistake that limits financial growth. While savings accounts are safe, they typically provide very low interest rates that do not keep up with inflation. Investing in stocks, bonds, mutual funds, or real estate offers greater potential returns and helps grow wealth over time. A diversified investment portfolio balances risks while maximizing opportunities.

Keeping all your savings in a basic bank account is another mistake that limits financial growth. While savings accounts are safe, they typically provide very low interest rates that do not keep up with inflation. Investing in stocks, bonds, mutual funds, or real estate offers greater potential returns and helps grow wealth over time. A diversified investment portfolio balances risks while maximizing opportunities.

An emergency fund gives you the flexibility and independence to make choices in life. It allows you to confidently pursue new opportunities, such as a career change, starting a business, or furthering your education. With an emergency fund, you can take calculated risks and make decisions based on your long-term goals rather than being solely driven by immediate financial needs. It provides a safety net, empowering you to navigate unexpected situations without compromising your dreams and aspirations.

An emergency fund gives you the flexibility and independence to make choices in life. It allows you to confidently pursue new opportunities, such as a career change, starting a business, or furthering your education. With an emergency fund, you can take calculated risks and make decisions based on your long-term goals rather than being solely driven by immediate financial needs. It provides a safety net, empowering you to navigate unexpected situations without compromising your dreams and aspirations.

One of the best things you can do for your future is to start saving for retirement as early as possible. The sooner you start, the more time your money has to grow. If you wait until later in life to begin saving, you’ll have to save much more each month to catch up. Investing in a 401(k) or IRA is a great way to save for retirement. If your employer offers a 401(k) match, take advantage of it – it’s free money.

One of the best things you can do for your future is to start saving for retirement as early as possible. The sooner you start, the more time your money has to grow. If you wait until later in life to begin saving, you’ll have to save much more each month to catch up. Investing in a 401(k) or IRA is a great way to save for retirement. If your employer offers a 401(k) match, take advantage of it – it’s free money. When it comes to investing, there are many different options available. Diversifying your investment portfolio is essential, so you’re not putting all your eggs in one basket. A mix of stocks and bonds is an excellent way to diversify your investments. This will help minimize your risk while still allowing you the potential to earn a good return on your investment.

When it comes to investing, there are many different options available. Diversifying your investment portfolio is essential, so you’re not putting all your eggs in one basket. A mix of stocks and bonds is an excellent way to diversify your investments. This will help minimize your risk while still allowing you the potential to earn a good return on your investment.

One option for funding your small business is to

One option for funding your small business is to  Finally, another option for financing your small business is to take advantage of government programs. Several different programs are available, including loans, grants, and tax breaks. The best program for you will depend on your circumstances. Keep in mind that the application process can be complicated, so it is essential to do your research and have all necessary documentation in order.

Finally, another option for financing your small business is to take advantage of government programs. Several different programs are available, including loans, grants, and tax breaks. The best program for you will depend on your circumstances. Keep in mind that the application process can be complicated, so it is essential to do your research and have all necessary documentation in order.

We’re sure that you have had a financial crisis at least once in your life. This could be anything from an unexpected car repair bill to a medical emergency. When these things happen, you need cash fast, and a payday loan can provide that for you. You can get the money in your bank account within one business day so that you don’t have to worry about how you’re going to pay your bills.

We’re sure that you have had a financial crisis at least once in your life. This could be anything from an unexpected car repair bill to a medical emergency. When these things happen, you need cash fast, and a payday loan can provide that for you. You can get the money in your bank account within one business day so that you don’t have to worry about how you’re going to pay your bills. Payday lenders are much more flexible than banks when it comes to repaying your loan. You may arrange a repayment plan that works for you so that you don’t have to stress about making a payment on time. This can be very helpful if you’re dealing with a financial emergency.

Payday lenders are much more flexible than banks when it comes to repaying your loan. You may arrange a repayment plan that works for you so that you don’t have to stress about making a payment on time. This can be very helpful if you’re dealing with a financial emergency.

No one should ever take out a loan without first consulting with an expert. Financial professionals know what they’re doing and will help you avoid making mistakes. Before signing any loan agreements, carefully read through them to ensure that there aren’t any hidden fees or surprises.

No one should ever take out a loan without first consulting with an expert. Financial professionals know what they’re doing and will help you avoid making mistakes. Before signing any loan agreements, carefully read through them to ensure that there aren’t any hidden fees or surprises.

Many entrepreneurs operate as sole traders for many years and enjoy good business relations with customers and other parties. However, incorporating your business can positively impact how clients, suppliers, and others view you. Some parties consider operating as a limited company as more professional than running as a sole trader. Consequently, you could realize an improvement in your revenues after register a company than previously when you operated as a sole trader.

Many entrepreneurs operate as sole traders for many years and enjoy good business relations with customers and other parties. However, incorporating your business can positively impact how clients, suppliers, and others view you. Some parties consider operating as a limited company as more professional than running as a sole trader. Consequently, you could realize an improvement in your revenues after register a company than previously when you operated as a sole trader. Since so many things can go wrong when running a

Since so many things can go wrong when running a

convenient for many because you don’t have to deal with long queues in banks. Some of them can also be accessed with a poor credit score. Most lenders will only look at your employment details to confirm your eligibility. Getting faster approvals can be challenging at times. Here is how you can have your loan application approved fast.

convenient for many because you don’t have to deal with long queues in banks. Some of them can also be accessed with a poor credit score. Most lenders will only look at your employment details to confirm your eligibility. Getting faster approvals can be challenging at times. Here is how you can have your loan application approved fast. amount you can borrow. Borrowing anything more than the set limit may get your approval declined. It will help if you stick to your limit for faster approval. Remember to repay the amount within the agreed period. This will help improve your record with the specific online lender. Follow these tips for quick online loan approvals.…

amount you can borrow. Borrowing anything more than the set limit may get your approval declined. It will help if you stick to your limit for faster approval. Remember to repay the amount within the agreed period. This will help improve your record with the specific online lender. Follow these tips for quick online loan approvals.…

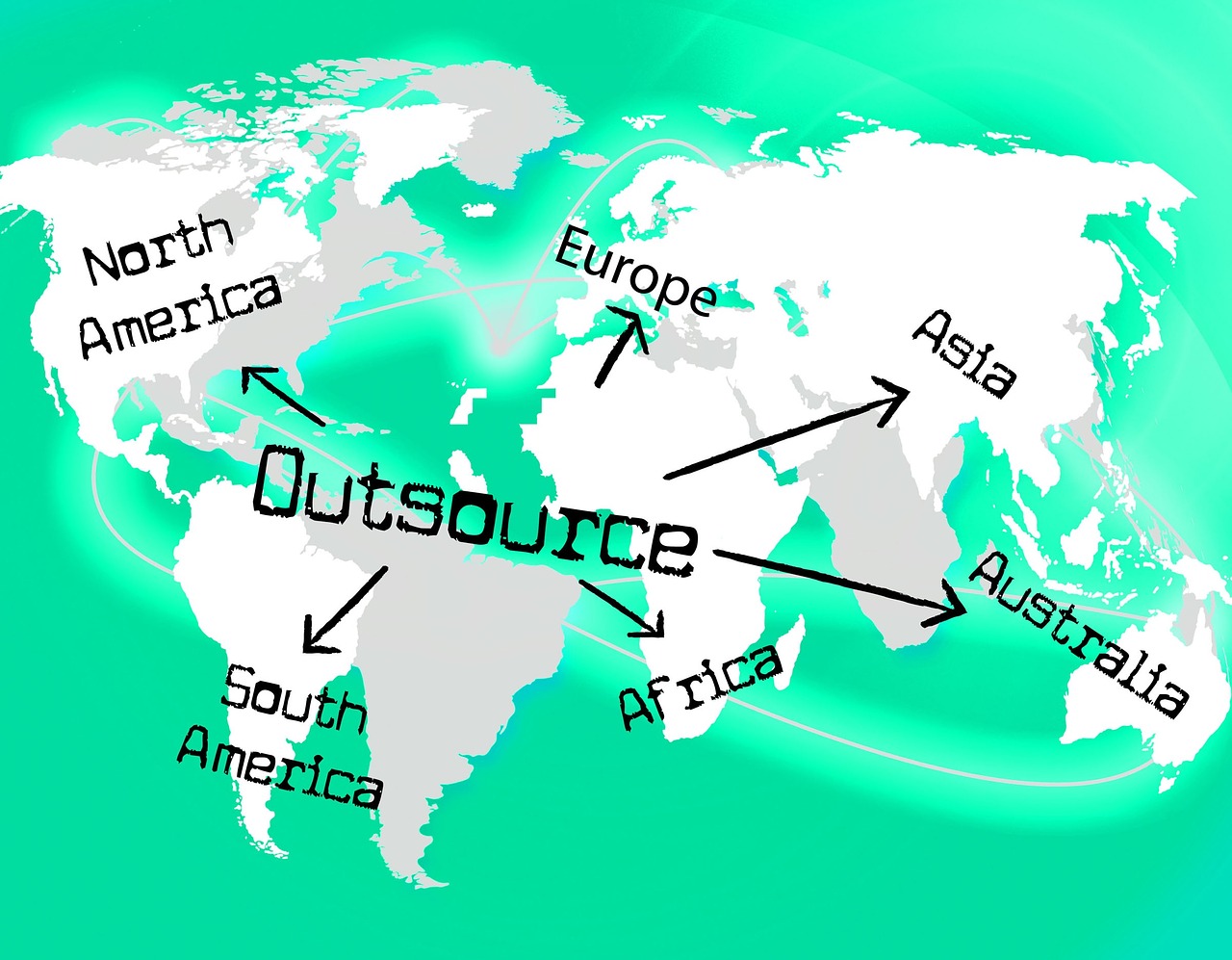

Outsourcing your process means you do not have to hire a staff member. You will have a fixed payment agreement with the provider to pay for a person to handle the required task. There is no need to spend money of space, furniture, wages, insurance and other staff related expenses. You only pay a fixed amount to the center that handles the work for your firm.

Outsourcing your process means you do not have to hire a staff member. You will have a fixed payment agreement with the provider to pay for a person to handle the required task. There is no need to spend money of space, furniture, wages, insurance and other staff related expenses. You only pay a fixed amount to the center that handles the work for your firm.

For someone who rises the music ranks and starts to earn millions of dollars, managing their money would become a problem. Many singers opt to find a financial manager to run their accounts and expenditures. These are qualified money experts and know what best way to invest and spend money.

For someone who rises the music ranks and starts to earn millions of dollars, managing their money would become a problem. Many singers opt to find a financial manager to run their accounts and expenditures. These are qualified money experts and know what best way to invest and spend money. On top of having a financial manager, some musicians will involve a financial planner. This is someone who will take a look at the money coming in and going out and then establish a sustainable plan. Such a plan will ensure that the spending rate is lower than the money coming in. This will create room for saving and investments. Through such planners, some musicians and their families will never have to worry about money for their entire life

On top of having a financial manager, some musicians will involve a financial planner. This is someone who will take a look at the money coming in and going out and then establish a sustainable plan. Such a plan will ensure that the spending rate is lower than the money coming in. This will create room for saving and investments. Through such planners, some musicians and their families will never have to worry about money for their entire life

On the other hand, there are cases where the insurance was added to the loan amount. This had the effect of adding the loan amount, which meant the customer had to pay interest on both the premium and the loan. There were also cases where the insurance expired, and the client was forced to pay interest on an insurance policy that was never meant to protect them.

On the other hand, there are cases where the insurance was added to the loan amount. This had the effect of adding the loan amount, which meant the customer had to pay interest on both the premium and the loan. There were also cases where the insurance expired, and the client was forced to pay interest on an insurance policy that was never meant to protect them.

Once you start to get behind in your payments, your phone will start ringing. They will even call you at work. They will tell you things like you will have to pay a significant amount for the phone calls to stop coming in. You can tell them that you don’t have the money and they will still request you to make a payment. Some will even ask you to make a payment over the phone, and they will defer the payment for when you have the money in your bank account.

Once you start to get behind in your payments, your phone will start ringing. They will even call you at work. They will tell you things like you will have to pay a significant amount for the phone calls to stop coming in. You can tell them that you don’t have the money and they will still request you to make a payment. Some will even ask you to make a payment over the phone, and they will defer the payment for when you have the money in your bank account. You will start sending a payment in each week. The debt services will split the payment up and start sending it to the card companies. In most cases, you will be able to keep the card, but in some cases, you will have to surrender the card back to the company. By using debt services, you won’t hurt your credit as bad as it would if you didn’t work with them at all.…

You will start sending a payment in each week. The debt services will split the payment up and start sending it to the card companies. In most cases, you will be able to keep the card, but in some cases, you will have to surrender the card back to the company. By using debt services, you won’t hurt your credit as bad as it would if you didn’t work with them at all.…

Sticking to the budget will enable an individual to speed up savings or ramp up investments. Having a budget gives someone a sense of responsibility such that they can assign every penny they get for a specific use. One will not spend blindly. They are also able to see how they spend their money. If they want to pay off debt, they can know which expense to cut off so that they can pay off debt faster. In other words, a budget helps to make sound financial decisions.

Sticking to the budget will enable an individual to speed up savings or ramp up investments. Having a budget gives someone a sense of responsibility such that they can assign every penny they get for a specific use. One will not spend blindly. They are also able to see how they spend their money. If they want to pay off debt, they can know which expense to cut off so that they can pay off debt faster. In other words, a budget helps to make sound financial decisions.

Eating out is expensive. Some people survive on fast foods because they can’t cook. It is advisable that they eat out at most once in a month. When they practice that for two years, the savings are enough to buy a good used car.

Eating out is expensive. Some people survive on fast foods because they can’t cook. It is advisable that they eat out at most once in a month. When they practice that for two years, the savings are enough to buy a good used car.